It means the company’s earnings before interest and taxes are eleven times greater than its interest expenses. Moreover, Times Interest Earned measures the number of times you can pay your interest expenses within a certain period of time. Although it is not necessary for you to repay debt obligations multiple times, a higher ratio indicates that you have more revenue. Companies use a variety of metrics to measure their financial health. One example of these metrics is the times interest earned ratio. It’s important that you understand how to properly calculate this metric.

Results

Again, there is always more that goes into a decision like this, but a TIE ratio of 2.5 or lower is generally a cause for concern among creditors. Here’s a breakdown of this company’s current interest expense, based on its varied debts. In a perfect world, companies would use accounting software and diligence to know their position and not consider a hefty new loan or expense they couldn’t safely pay off.

What Does a Times Interest Earned Ratio of 0.90 to 1 Mean?

Learn more about how to prep yourself for an SBA loan that can help grow your business and have cash reserves so that you can build better product experiences. When you sit down with the financial planner to determine your TIE ratio, they plug your EBIT and your interest expense into the TIE formula. Simply put, your revenues holiday season minus your operating costs and expenses equals your EBIT. Expenses include things like building fees and the cost of goods sold. The significance of the interest coverage ratio value will be determined by the amount of risk you’re comfortable with as an investor. The problem happens if we are getting close to a value of 1.

- If you find yourself with a low times interest earned ratio, it should be more alarming than upsetting.

- The Times Interest Earned Ratio is a valuable financial metric for both investors and creditors, helping assess a company’s ability to manage its interest payments.

- Lenders make these decisions on a case-by-case basis, contingent on their standard practices, the size of the loan, and a candidate interview, among other things.

- Lenders become more cautious since it means the risk of credit default for them increases.

Interest coverage ratio as a debt ratio

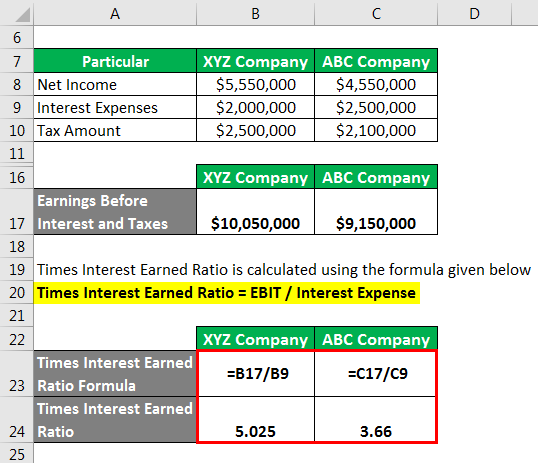

The Times Interest Earned (TIE) Ratio is a financial metric used to evaluate a company’s ability to meet its debt obligations. It measures how many times a company can cover its interest expenses with its earnings before interest and taxes (EBIT). This ratio is crucial for creditors and investors as it provides insight into the company’s financial stability and risk level. Our Times Interest Earned Ratio Calculator simplifies the calculation process, helping you assess your company’s capacity to meet interest payments efficiently.

Other calculators

This means the company can cover its interest expenses five times over, indicating strong financial stability. Now, let’s talk about what a good times interest earned ratio is. A good TIE ratio is subjective and can vary widely depending on the industry, economic conditions, and the specific circumstances of a company.

Related Calculators

Based on the times interest earned formula, Hold the Mustard has a TIE ratio of 80, which is well above acceptable. As we previously discussed, there is a lot more than this basic equation that goes into a lender’s decision. But you are on top of your current debts and their respective interest rates, and this will absolutely play into the lender’s decision process. While this ratio does show you how much of a company’s leftover earnings are available to pay down the principal on any loans, it also assumes that a firm has no mandatory principal payments to make. The EBIT figure for the time interest earned ratio represents a firm’s average cash flow, and is basically its net income amount, with all of the taxes and interest expenses added back in.

That is why people consider it a reliable company worth having in their retirement investing plan. This section will compare Lockheed Martin Corp and Boeing Company, both related to the airplane manufacturing industry, based on their interest coverage ratio. The TIE ratio uses EBIT, which excludes taxes, so tax benefits do not directly affect the calculation. However, tax advantages can improve overall financial performance.

A company’s capitalization is the amount of money it has raised by issuing stock or debt, and those choices impact its TIE ratio. Businesses consider the cost of capital for stock and debt and use that cost to make decisions. Creditors use the TIE ratio to assess the risk of lending to a company. A higher ratio suggests that the company is more likely to be able to meet its interest obligations, reducing the risk of default. Please note that EBIT represents all of the profits your business earned during the relevant accounting period. This doesn’t include any interest, taxes, or other factors.