Bookkeeping franchises are a type of franchise business that provides bookkeeping services to small and medium-sized businesses. The franchisor provides the franchisee with a proven business model, brand name, ongoing support, training, marketing, and other benefits in exchange for an upfront fee and ongoing royalties. After starting with $200, 2 computers and a fax machine the company became one of the largest tax preparation providers in New York. ATAX Franchise, Inc, was launched in 2007 and began expanding along the East Coast of the US and future plans include nationwide growth. ATAX is a full-service national tax preparation and business services franchise.

Our Franchise Bookkeeping Services

We value your privacy and will never share your information with third parties. You may opt out of receiving these communications at any time by replying “STOP” to any text message or by contacting us directly. Paramount Tax is the reputable touch that a small business wants, instead of being an outsider to a business you would be a partner to both your clients and to us. When he’s not crunching numbers, Jason enjoys unwinding by playing guitar and piano, sharing his love for music with his wife and three kids. He’s also a computer programmer and the creator of Huskey Practice Manager, a tool designed to help streamline accounting practices. Here on the blog, Jason shares insights from his experiences in both accounting and tech.

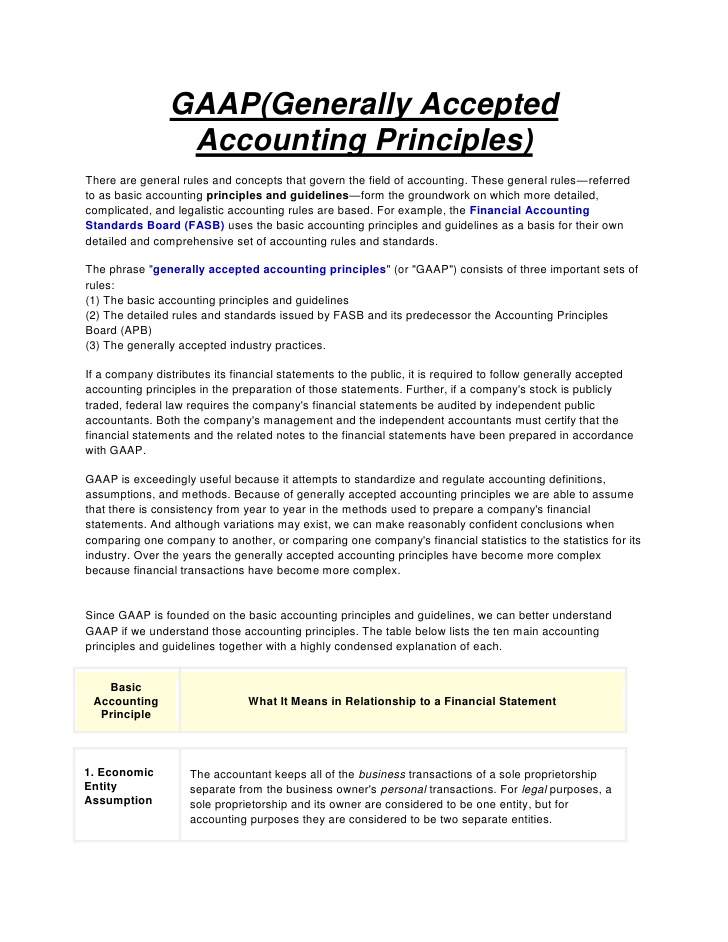

Whether you are a seasoned franchisee or exploring the feasibility to become one, Gatlin Rago CPA Group will manage all the financial needs of your franchise(s). The basic transactions that bookkeepers carry out for businesses include purchase, sales, receipts, and payments by an individual person or an organization/corporation. Although there are quite a few standard methods of bookkeeping, methods such as the single-entry and the double-entry bookkeeping system are used.

Starting a bookkeeping franchise can have several advantages, including access to a proven business model, brand name recognition, and training and support from the franchisor. However, there are also some disadvantages to consider, such as the high startup costs and the requirement to follow the franchisor’s guidelines. The decision of whether or not to start a bookkeeping franchise should be based on your personal preferences and best procurement software for small and midsize businesses budget. As a franchise partner, you will realize how lucrative the bookkeeping franchise is and with our business model, we are sure you can see how much integrity we put into a booming industry. Outsourced financial aid is a $145 billion dollar industry, with a growth of $10 billion dollars annually. Nestled within that industry is the bookkeeping and payroll subsection which itself garners close to $80 billion annually and employs almost a million people across the United States.

Daniel Ahart Tax Service

With the right franchise, aspiring entrepreneurs can receive training and support to help them build a successful bookkeeping business of their own. A bookkeeping franchise is a type of business where the franchisor provides a proven business model, brand name, and ongoing support to the franchisee. The franchisee pays an upfront fee and royalties in exchange for these benefits. If the pain points of franchise finance management are starting to drag you down, it’s time to hire professionals trained to manage bookkeeping for franchises. At Remote Quality Bookkeeping, we help franchise owners get their financial records under control.

- This way you can know who has paid and what is left to pay at a simple glance.

- The decision of whether or not to start a bookkeeping franchise should be based on your personal preferences and budget.

- A bookkeeping franchise can be very valuable to owners because thousands of companies outsource some accounting processes every day.

- When you hire us to handle your remote bookkeeping services, you remove any issues that come from different franchisees handling reports their own way.

- Franchise bookkeeping involves additional audits and compliance checks far beyond what’s involved with an independent small business.

Low Start-up Costs

This is because bookkeepers can do some of the monotonous work that an accounting department has, like matching invoices or day-to-day transition recording. Even when a company has an in-house accounting department, a bookkeeper can generate data and reports, leaving more time for them to handle higher-level tasks like financial insights and direction. Their team of 40 bookkeepers are all trained to manage accounts in accordance with the Books Onsite Accounting Manual which is customized for each client. If you are interested in this franchise, you can contact them via their corporate head office address as stated above. Award Bookkeeping Company provides only top – quality bookkeepers to help you control your finances and manage your business better. They have their corporate head office at Suite Manchester Road, Moorolbark Victoria 3138.

As the owner and operator of the franchise, you’ll need to have a strong understanding of bookkeeping 47 habits of highly successful employees or accounting operations. Failing to follow proper local, state, and federal regulations for sales and income taxes can lead to serious financial penalties, legal action, and damage to your franchise’s reputation. When these issues continue due to poor franchise bookkeeping, you run the risk of losing your business license.

Bookkeepers generally handle the day-to-day recording of transactions in a business. It’s their job to ensure that the books stay balanced by monitoring accounts and transactions. Yes, we can provide references and case studies that showcase our successful partnerships with franchise businesses. Franchise bookkeeping involves additional audits and compliance checks far beyond what’s involved with an independent small business.

Best Accounting & Bookkeeping Franchise Opportunities for Sale and Their Cost

The franchisee is responsible for following the franchisor’s proven business model, operating the bookkeeping business according to the franchisor’s guidelines. Proper record-keeping is essential for franchise owners to maintain financial transparency and meet legal and financial reporting requirements. However, keeping organized records for multiple locations can be a daunting task. Paramount Tax and Accounting, we offer our clients the freedom to run their business without the chaos of having to do it themselves. Our expert and reputable support with these expansive services from our accountants give increased visibility and access to more capital for our clients. Headquartered in Greenwood Village, Colorado, Payroll Vault Franchising is a full-service entrepreneur for small businesses.

Let us handle your franchise bookkeeping so you can return to handling business. Choosing to become one of our franchise partners will keep you busy from day one. You as a possible franchise partner would be treated just as our clients would with that continued support out in the break even analysis for restaurants field.